The next several weeks could finally bring a truce in the US-China trade war, but that doesn't mean the deepest issues between the countries will be resolved. China expert

Michael Hirson examines the problems a deal might solve and the challenges that are likely to remain.

How will the US and China benefit from a trade agreement?

The upcoming deal benefits both countries in the near-term by removing the current threat of tariff escalation. Pockets of the US economy will gain modestly from concessions by China in areas such as boosting imports of US crops and expanding market access for financial services firms. But this truce is both fragile and limited. It does little to address the heightened geopolitical competition and fundamental divergences in economic models that the trade war has laid bare.

What will tech competition between the two countries look like going forward?

The technology competition at the heart of the trade dispute will continue uninterrupted; both countries view it as critical to their intensifying economic and military rivalry. Washington and Beijing will use non-tariff measures, such as investment restrictions and regulatory actions, to seek independence from each other in strategically important sectors such as 5G networks and artificial intelligence. Such barriers will make it difficult for the two countries to share innovation and hamper the ability of global supply chains to link the two economies as efficiently as in the past.

Could a trade agreement lead to economic reforms in China?

The agreement will largely fail to accomplish US aims to scale back Beijing's intervention in China's economy. Market reformers in China will seek to use the deal to advance economic liberalization measures domestic opponents have blocked, such as opening more sectors to foreign investment and reducing industrial subsidies. But the openly geopolitical nature of the trade dispute—with US officials publicly celebrating China's economic slowdown under tariffs, and taking aim at Chinese firms like ZTE and Huawei—does more to strengthen China's nationalist voices and Xi Jinping's statist impulses. It only furthers China's determination to achieve self-reliance from the US in areas such as semiconductors and software.

The fundamental divide between US and Chinese interests on core issues means the deal's implementation is likely to be rocky, with a real risk that the US will reimpose tariffs in the next one to two years. American companies in China may see improvement in the formal business environment, but will still face pervasive informal obstacles where China sees an advantage to limiting the role of foreign firms. For China to create a more level playing ground would require economic necessity or a coordinated multilateral campaign—which the US has thus far failed to muster—rather than unilateral US pressure.

The US political establishment will grow more hostile toward China in coming years, driven by consensus that it is the country's most formidable strategic competitor as well as frustration with China's lack of political and economic reform. Trump's hard-edged campaign against China now ensures that both parties will compete in upcoming elections on who can be toughest against Beijing.

Ultimately, the shortcomings of Trump's trade deal will force the US to develop a more unified and coherent strategy towards China. It should involve taking the strong point of Trump's approach—recognition that the past mode of US economic engagement was not working—and addressing its major weaknesses: the failure to fully enlist allies such as the EU and Japan, and the missing link to domestic policies to boost US economic and technological competitiveness.

An earlier version of this article originally appeared in ChinaFile.

SUBSCRIBE TO GZERO DAILY

Sign up now for GZERO Daily, the newsletter for anyone interested in global politics, published by GZERO Media.

Michael Hirson leads Eurasia Group's coverage of China, with a focus on macroeconomic and financial policies, economic reforms, and political developments affecting foreign firms and investors. Prior to joining the firm, Michael served three years as US Treasury's chief representative in Beijing, engaging with China's government and the private sector on a broad set of macroeconomic, financial, and investment issues.

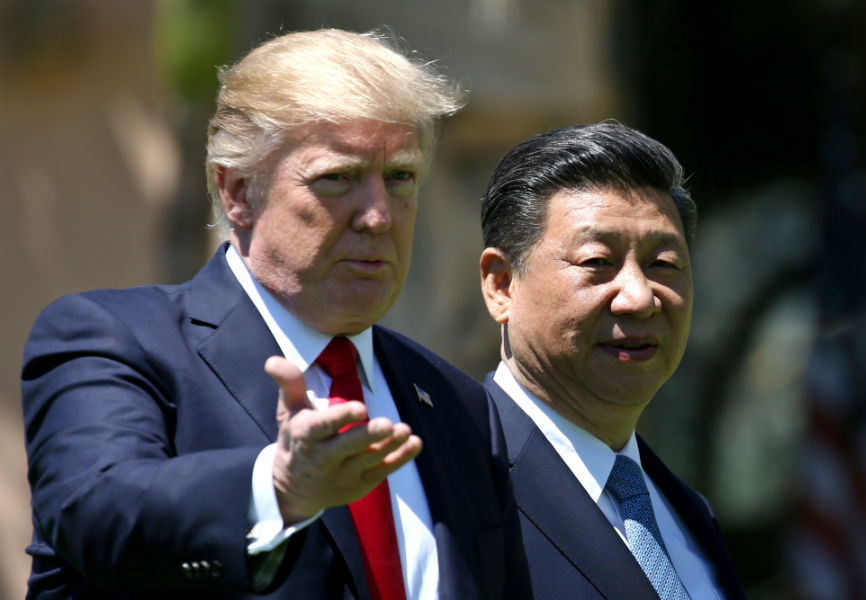

US President Donald Trump and Chinese President Xi Jinping. REUTERS.

US President Donald Trump and Chinese President Xi Jinping. REUTERS.