A long-awaited election

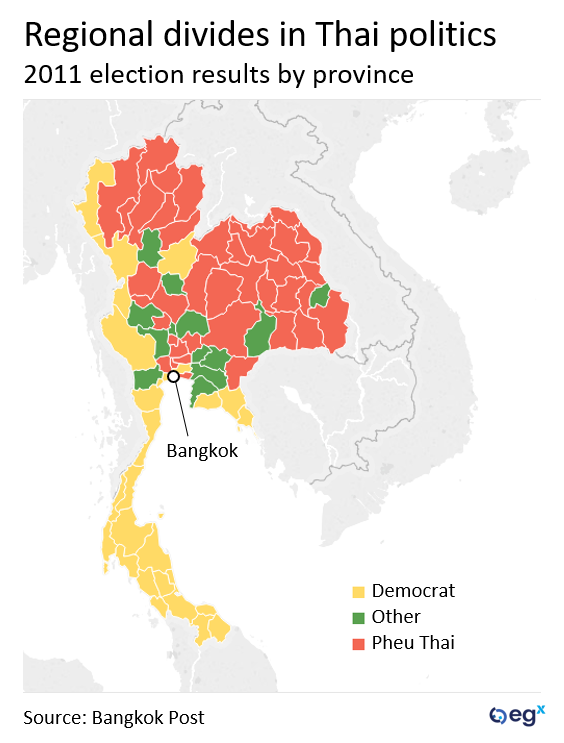

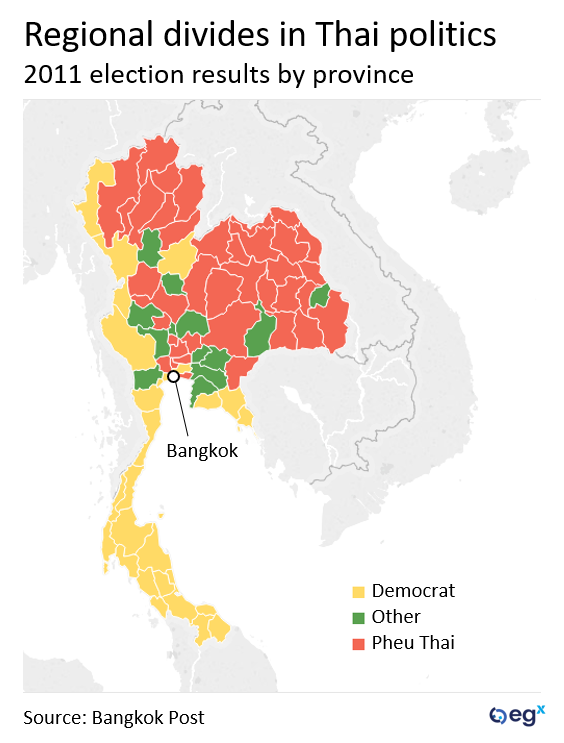

Thailand will head to the polls on 24 March in the first general election since the 2014 military coup. Thailand's last official election was held in 2011, when the populist Thaksin Shinawatra-backed Pheu Thai won a landslide victory over the pro-establishment Democrat party, exposing deep societal divisions that led to outbreaks of violence.

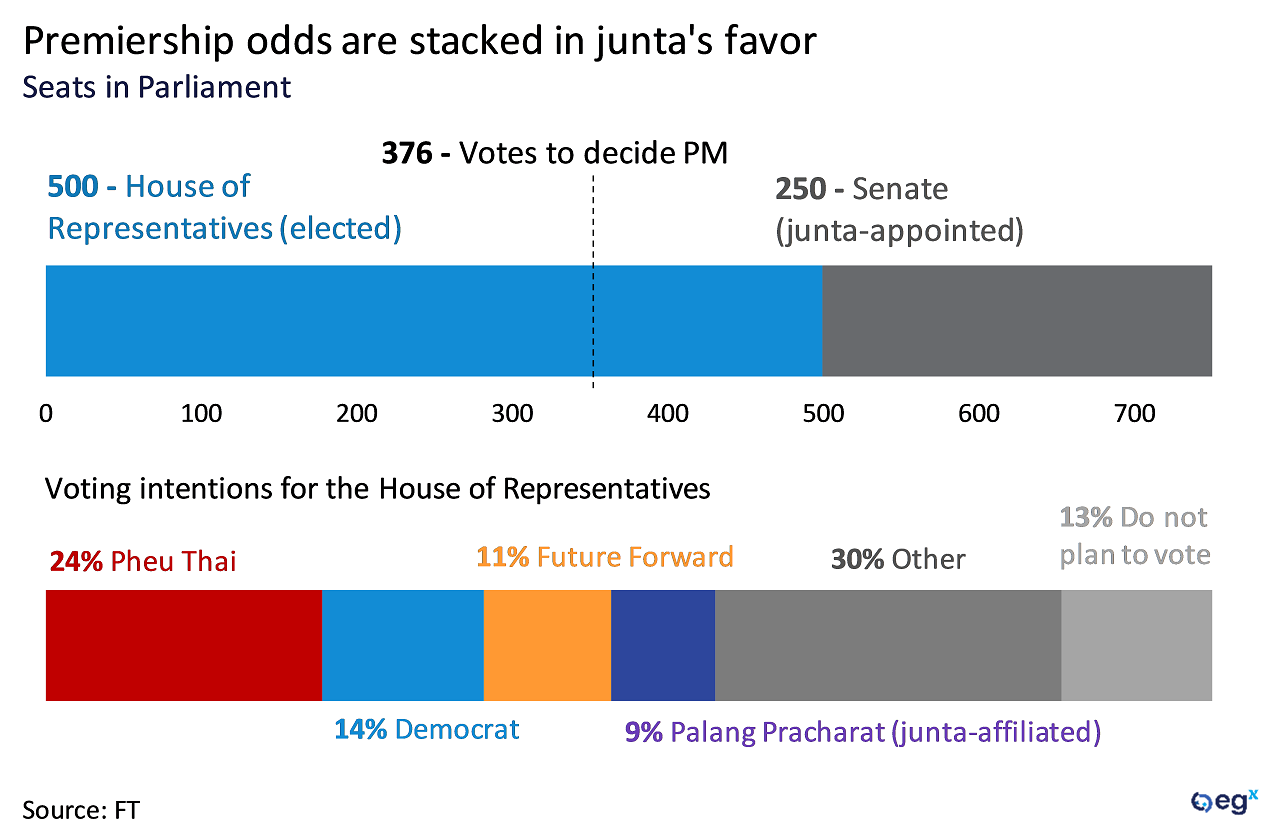

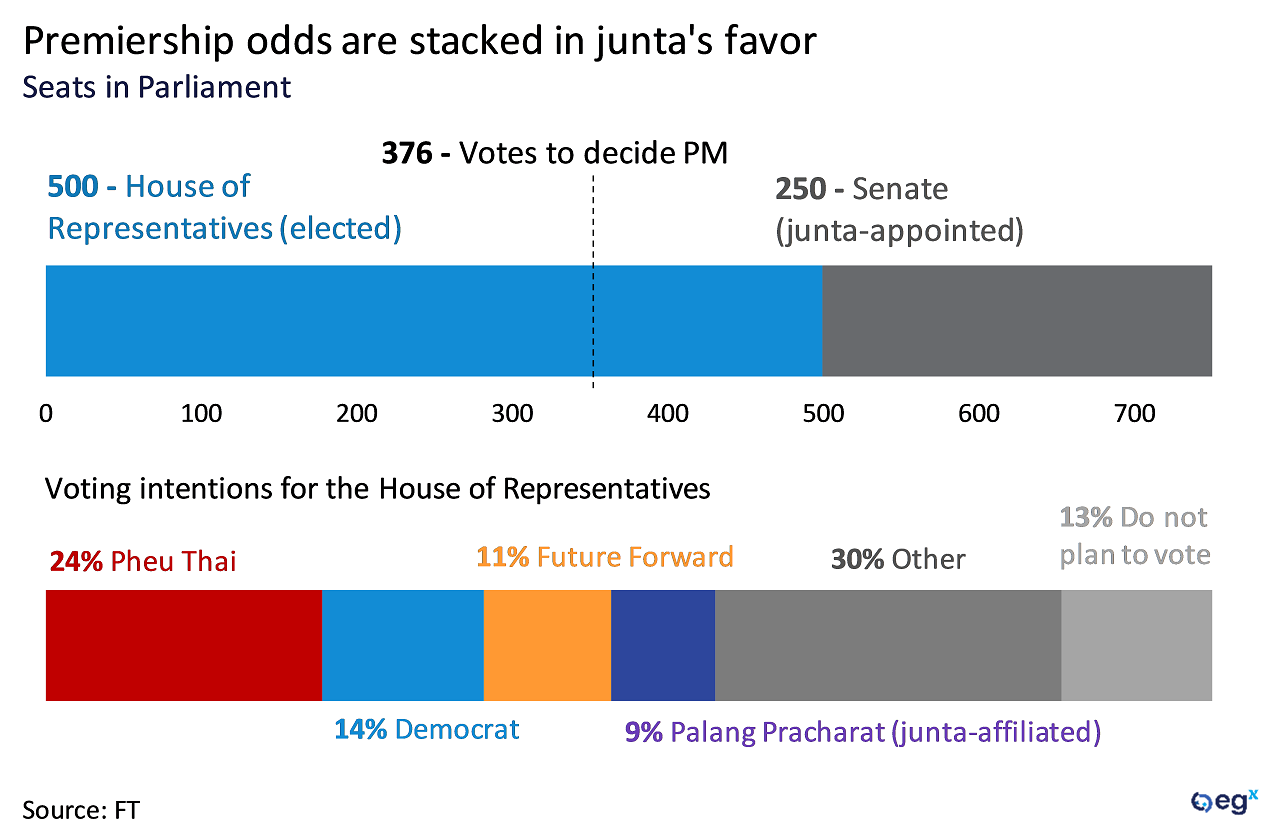

With Pheu Thai again leading the polls, the military junta is focused on maintaining its control over political life and preventing a return to social unrest. The recent decision to ban the Pheu Thai-affiliated Thai Raksa Chart party makes a hung parliament more likely, and the 250 junta-appointed senators will also help tilt the balance in favor of a prime minister who is aligned with the junta.

Despite stacking the odds in its favor, the junta is still anxious about maintaining control after the election, particularly given sensitivities around the coronation of King Maha Vajiralongkorn in early May. While unlikely, signs of social unrest or a strong showing by pro-democracy parties could trigger another military intervention, such as the cancellation or suspension of elections or another military coup.

Policy stability and stagnation

Policy stability and stagnation

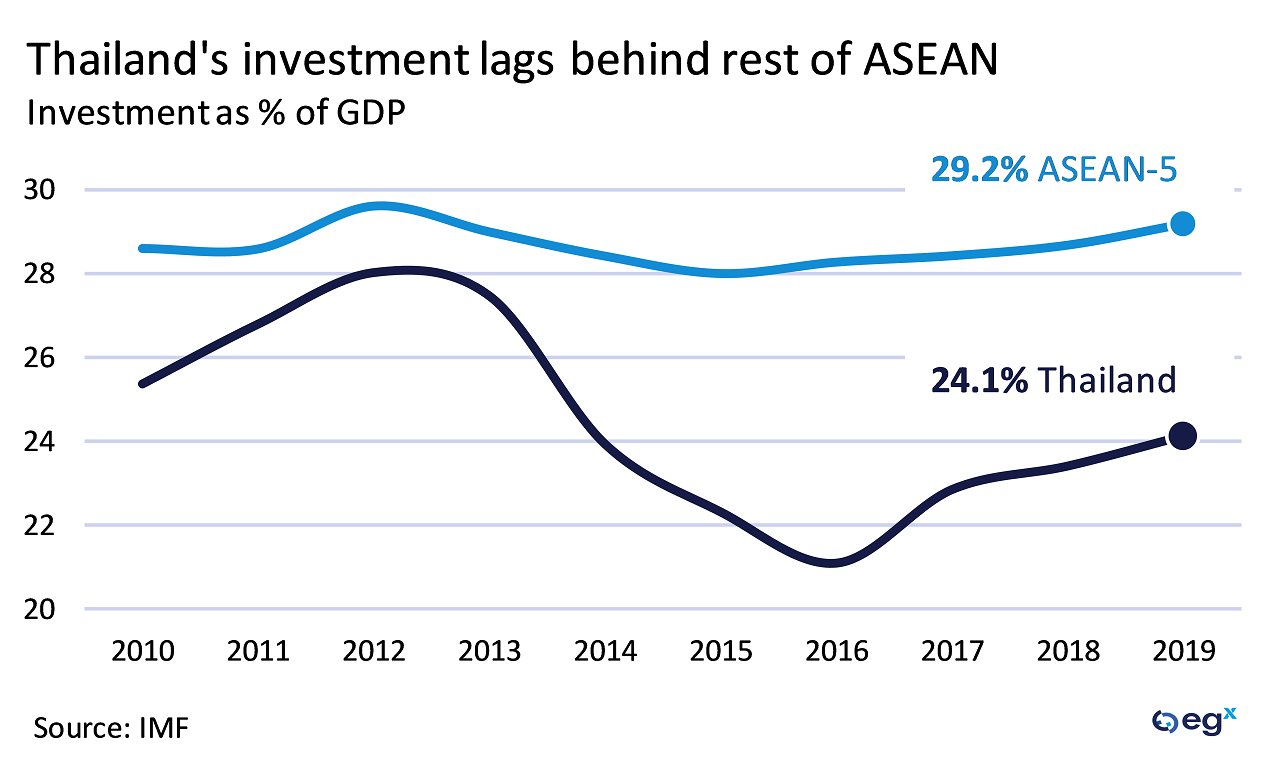

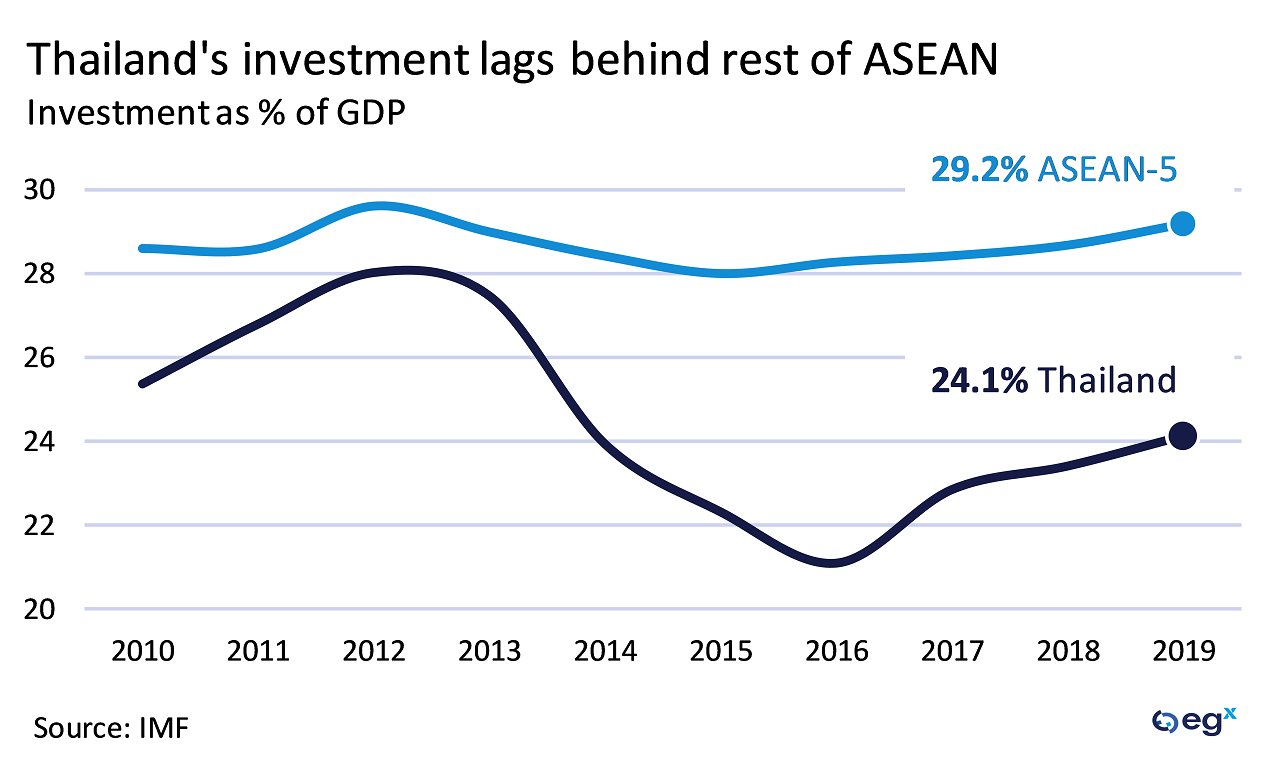

A junta-aligned government will offer broad policy continuity within the guidelines set by the military's National Strategy. While this will provide a measure of social and political stability, Thailand lags behind the rest of the region in investment.

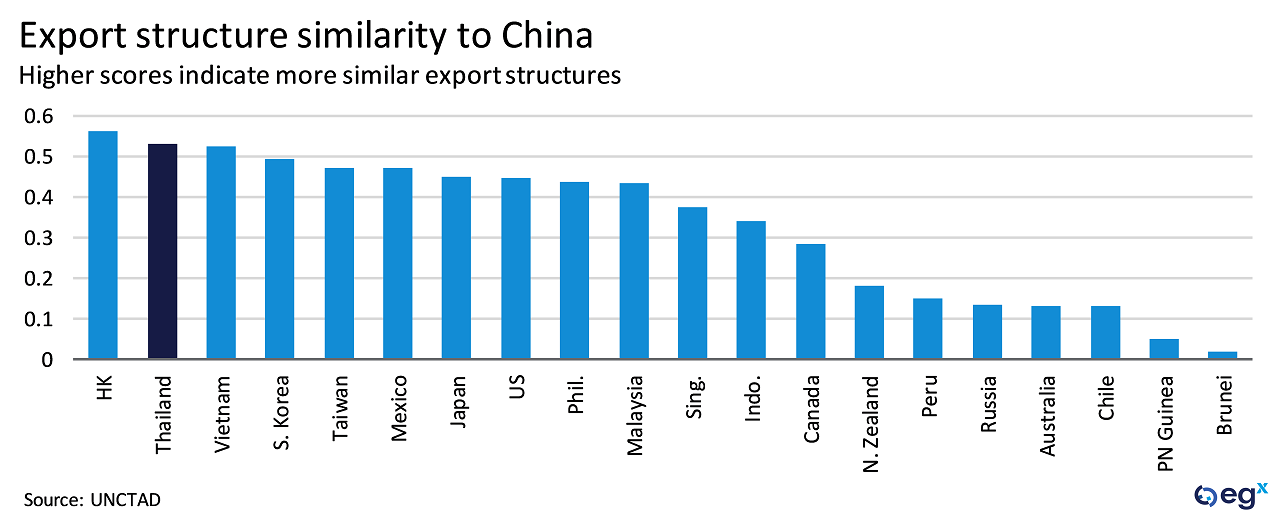

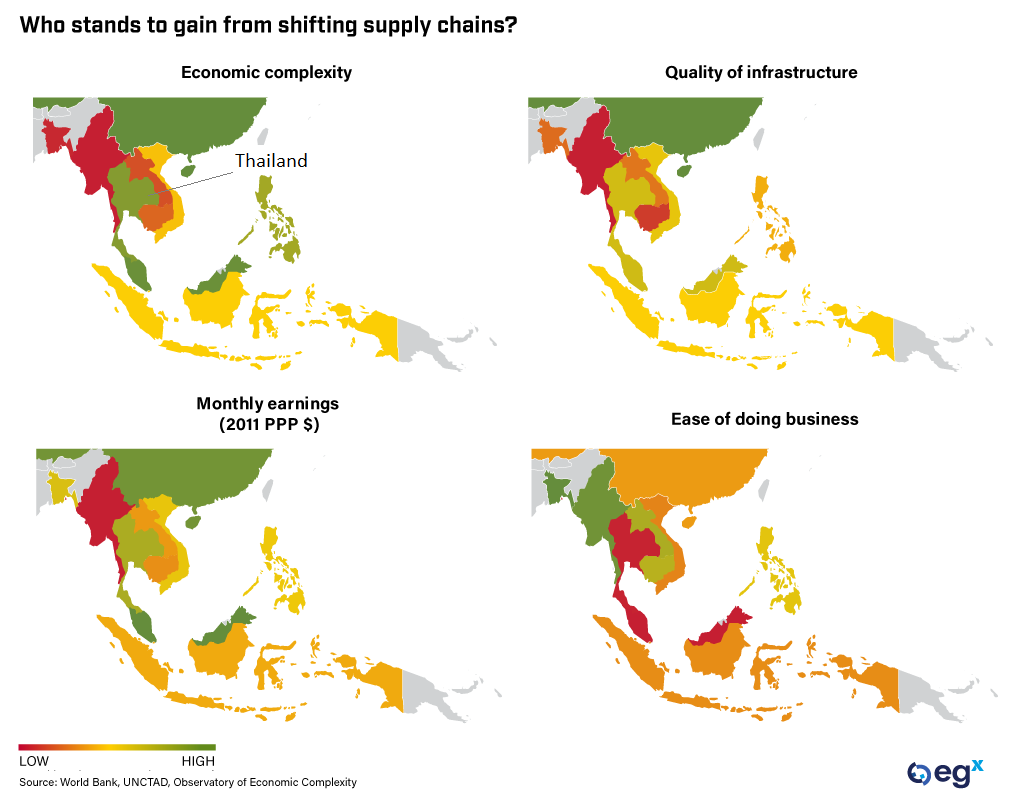

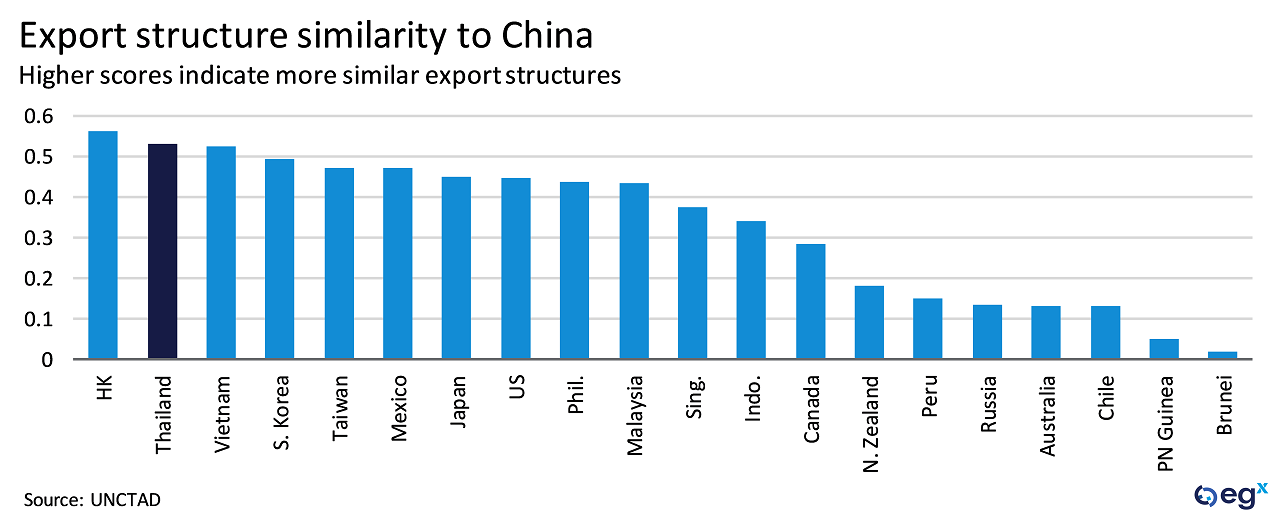

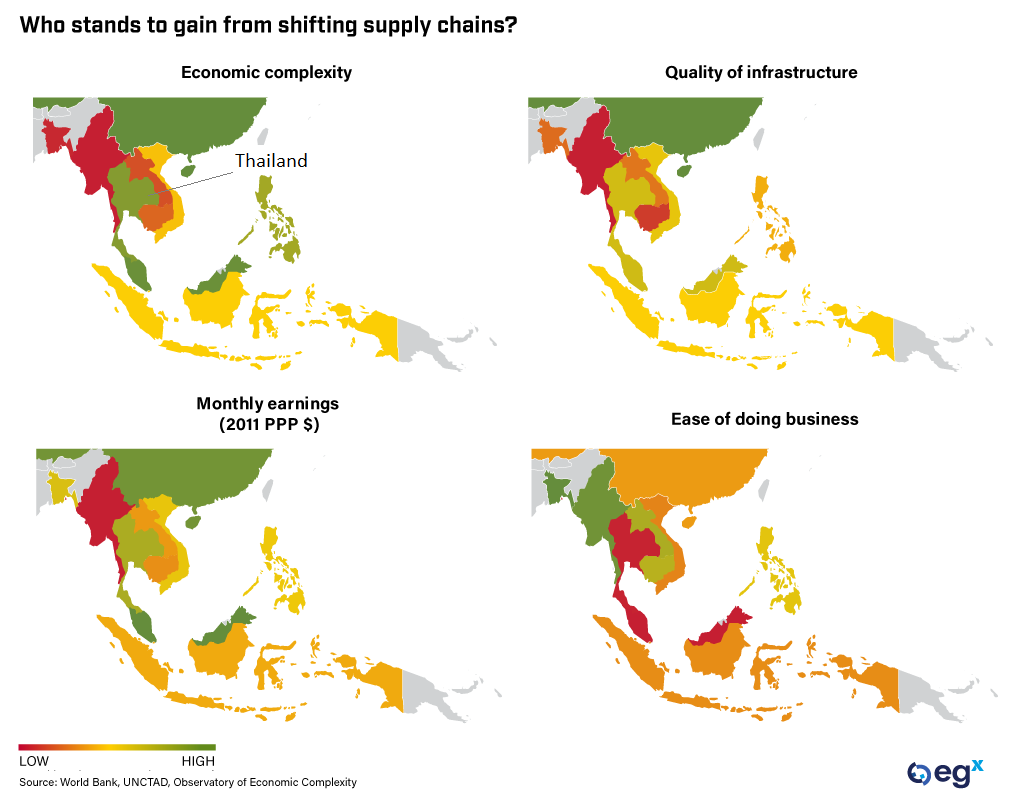

Thailand's regional position and relatively high export complexity positions it to benefit from the restructuring of supply chains as a result of US-China trade frictions. However, its poor business environment continues to weigh on its competitiveness.

The junta's continued influence is also unlikely to lead to structural reforms and the investment necessary to take advantage of the space provided by China's rise up the manufacturing value chain. It risks falling into the middle-income trap as its higher-wage labor force loses out to low-wage, low-income regional competitors such as Vietnam.