This year begins with more promising news on Covid-19 vaccine candidates than experts dared hope for. Citizens around the world are more optimistic that life will begin to return to normal in the first half of the year.

But neither the coronavirus nor its wide-ranging impacts will disappear once widespread vaccination begins. Countries will struggle to meet vaccination timelines, and the pandemic will leave a legacy of high public debt, displaced workers, and lost trust. Evolution of the virus could meaningfully change the goalposts on population immunity and vaccine effectiveness over time. Sharply different rates of recovery, both within and among countries, will stoke anti-incumbent anger and public unrest. In addition, emerging markets could face a financial crisis.

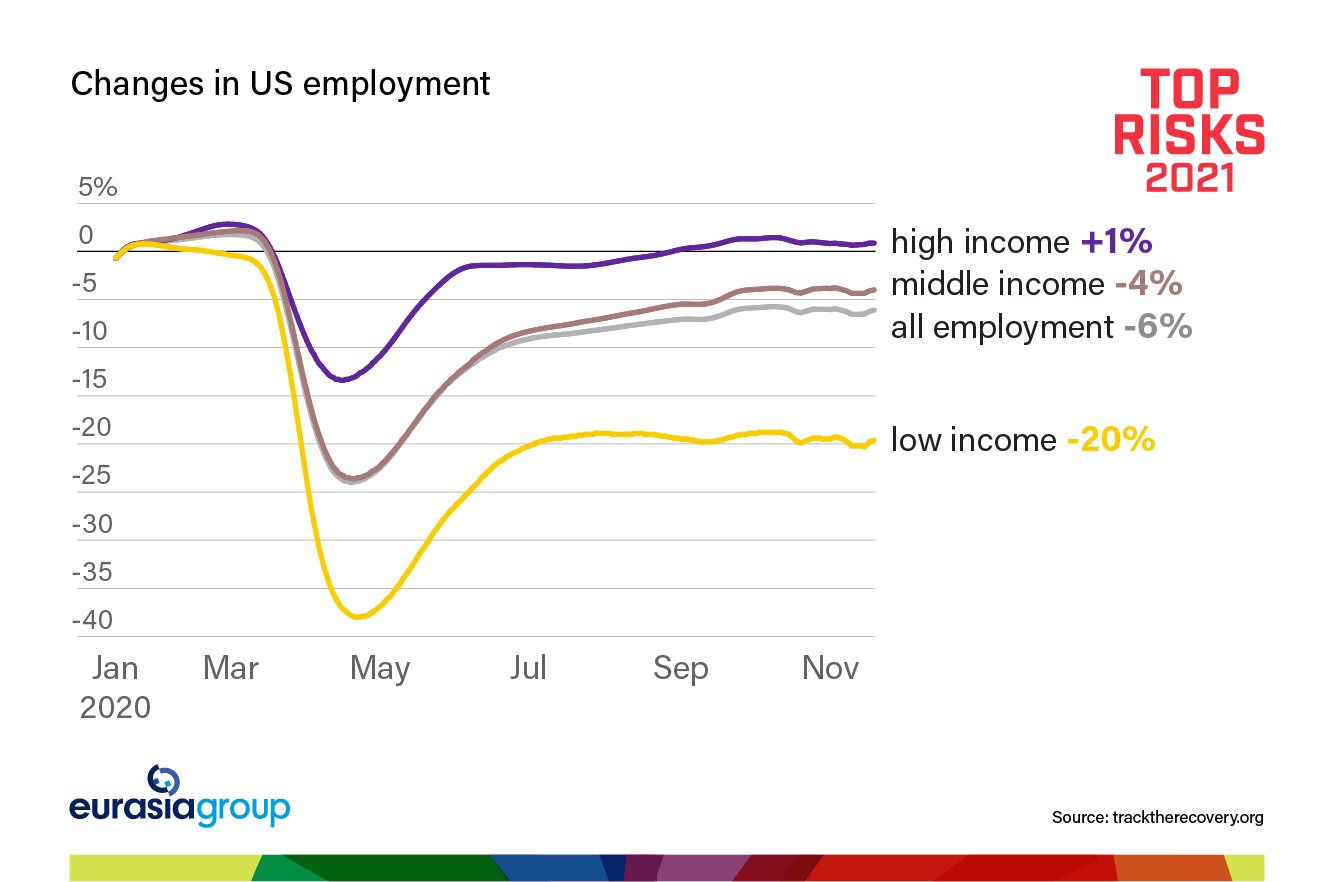

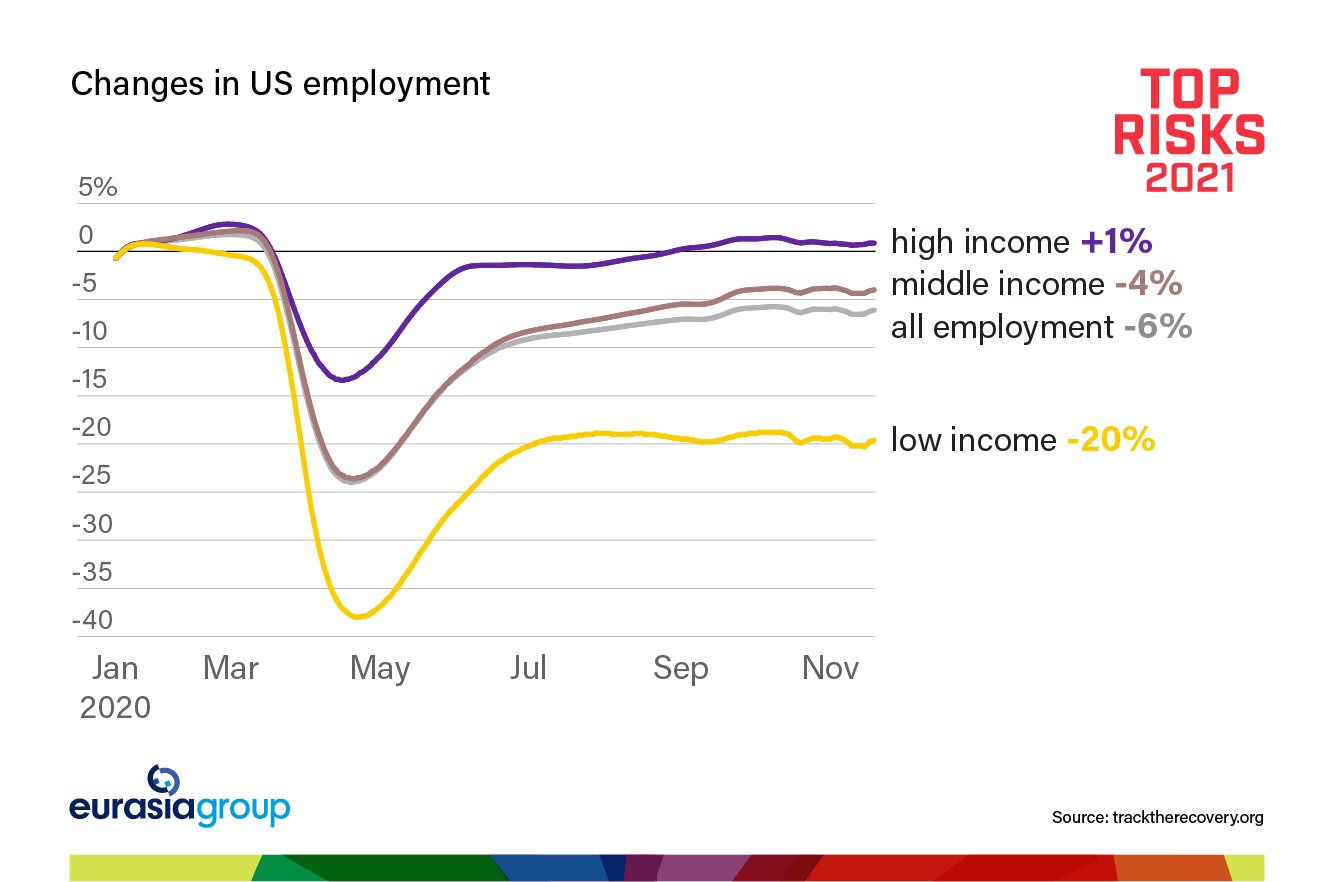

Inside developed and emerging markets. A K-shaped recovery, in which some groups thrive and others increasingly suffer, will plague all countries. Those who have borne the brunt of the virus—low-income and minority communities, women, and especially those people who work in the service sector—will also experience the most protracted drag on their earnings potential and the most uncertain path back to stable employment. This is primarily because stimulus plans and budgets will fall short, while the ability of central banks to underpin demand with price stability will be in doubt. In the US, any further stimulus that gets through Congress will be insufficient to lift up the most vulnerable. Europe's recovery fund will provide meaningful support only from late 2021; until then, cash-strapped periphery countries will need to find other sources of finance and risk triggering a spike in bond yields if they move to take on more debt to stimulate their economies. In emerging markets, low capacity to provide stimulus and safety nets means these effects will bite harder. The problem will be more acute in Latin America, the Middle East, and Southeast Asia than in eastern and southern Europe and Northeast Asia, where safety nets are stronger.

Among

Among developed and emerging markets.

Recovery paths will also vary greatly among countries—vaccine access, rollout performance, and debt being the main drivers—and emerging markets will suffer most. Many countries without their own vaccine manufacturing capacity will not receive supplies until later in 2021 or even 2022, because their inability to afford pre-purchases of vaccines leaves them at the back of the line. Vaccination programs in emerging markets will be slowed by poor infrastructure—for “cold chain” distribution, in particular—and leave out the most effective vaccines, which require it. Covax, the multilateral vaccination initiative, will help, but developing countries won't receive large numbers of doses until wealthier countries get their share. As a result, people in poorer countries will face tough travel restrictions, slowing growth. Even countries in Southeast Asia, where there have been fewer Covid-19 cases and deaths, will experience a prolonged trade and tourism dip, slowing economic recovery and exacerbating underlying class, ethnic, and religious divisions.

The wallop this year. With few exceptions, the pandemic did not destabilize governments in 2020 or create existential economic crises. Instead, it generated a rally-around-the-flag effect that compelled central banks to inject massive liquidity. But 2021 will expose the underlying vulnerabilities of many markets. Governments will grapple with the impact of the 2020 recession, massive debt increases, and thinner social safety nets.

Instability and anti-incumbent anger will grow around the world, leading to more protests and new opportunities for populist candidates. In the US, the K-shaped recovery will deepen the polarization discussed in

Top Risk #1, sustaining Trump's following and decreasing the quality of governance. Across developing markets, the stratified recovery will make already difficult governance harder for similar reasons.